Is a common question that many ask when it comes to finance.

The answer is MAYBE – but it depends on your objectives.

If you are planning to trade/stock pick your account then maybe you CAN.

But this requires immense skill AND the time to do it.

If you’re time poor (as most of us are) then maybe this is not viable.

Most people will be investing use a “Buy and Hold” strategy.

In which case we want our portfolio to COMPOUND.

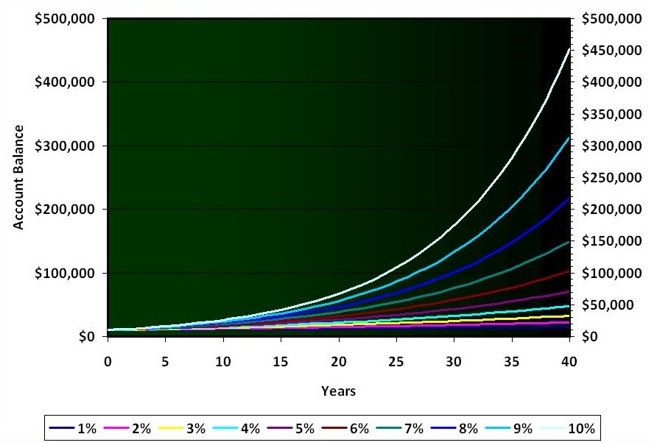

Compounding is one of those things that we often struggle to appreciate fully.

Compounding is the premise that certain things grow exponentially faster with time rather than linearly.

If our portfolio doesn’t compound then we can never hope to retire.

Therefore the MORE it compounds is the sooner we reach financial freedom.

Therefore, IF you use your ISA for “passive income” then you are INHIBITING your portfolios ability to compound.

Most would consider using the dividends of a stocks portfolio for these purposes.

Typically dividends yields are 3-4% – if we use 10% as a good rough metric of what can be attained from a fully equities portfolio…

Then its definitely worth looking at the effect on your eventual retirement pot using the graph below.

So the answer to the question Can I Invest In My ISA For Passive Income? is this:

YES – but it depends on your investing style and/or it may mean that our financial freedom date is not as soon as we’d like.

Fun fact for the day.

*NOT FINANCIAL ADVICE