The Gap

The Gap The Gap So what is “The Gap?” The gap is the difference between the life that we currently have and the life that we aspire to have.Many aspire

Inflation in a nutshell is a measurement for the rate at which everyday real-world prices increase over time. Its specifically a measurement of the prices we might pay for goods in shops NOT assets e.g. houses, stocks etc.

There are intricacies and debate about how to measure inflation and how accurate these measurements are. Broadly speaking however these are calculated in two ways RPI (Retail Price Index) and CPI (Consumer Price Index).

Analogies are super powerful to aid understanding – here is a useful one for those who wish to understand inflation to a much deeper level.

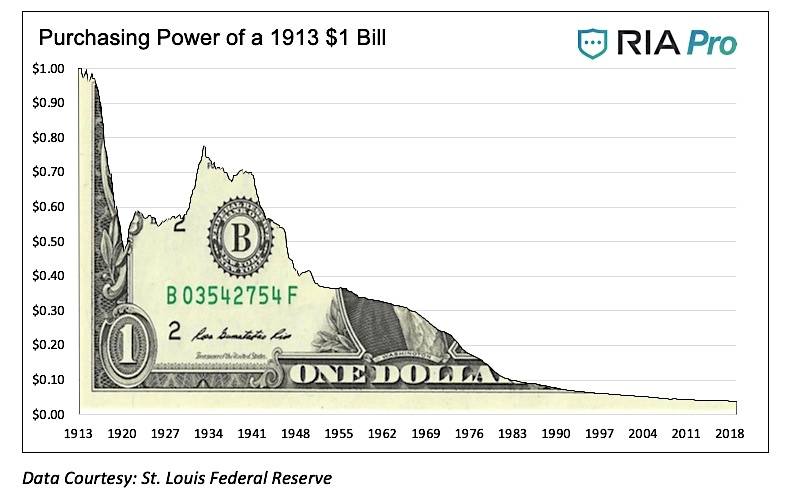

Lets imagine we wish to measure the dimensions of a house in terms of its length. We take a meter stick and place it alongside the house in an overlapping fashion. Upon completion of this process the house is found to be 10 meters long. As such the meter stick fits into the length of the house 10 times.

Now imagine that we remove 10cm from the edge of the meter stick yet even after this we STILL consider it to be one meter in length (even though its really 90cm). Lets try to measure the house again. We will find that more “meter sticks” fit into the length of the house (11.11 to be precise). Therefore, it appears the house has got LONGER; in reality it was our unit of measurement that got SHORTER.

To understand inflation, all we simply do is change the characteristic of the house we wish to measure from LENGTH to VALUE. Length is measured in meters (m) and house values are measure in currency, in this case we will use pounds (£). We can imagine that the house value when measured in £’s is £100,000.

So think of it like this, if the value of the pound goes down doesnt it take more units to measure the value of the house just like it took more meter sticks to measure the length?

So when we see the numerical value of our house increasing…. did the value of the house go up? or did the value of currency we use to measure said value go down…? To paraphrase, how much of this increase actually makes us WEALTHIER in reality?

….Generally speaking, its a little bit of both, its just important to remember that its usually not as much as it may appear.

*Not Financial Advice

Disclaimer: The content on this blog is meant for informational purposes only and does not constitute financial advice. Readers should seek guidance from a professional financial advisor before making any investment decisions.

The Gap The Gap So what is “The Gap?” The gap is the difference between the life that we currently have and the life that we aspire to have.Many aspire

Most Of Us Are On A Journey We Didn’t Sign Up For… Most Of Us Are On A Journey We Didn’t Sign Up For… We think it will lead us

Entrepreneurial Dentist Pioneers New Financial Education Platform Entrepreneurial Dentist Pioneers New Financial Education Platform Dr. James Martin leverages his dental acumen to fill a niche in financial education, launching an

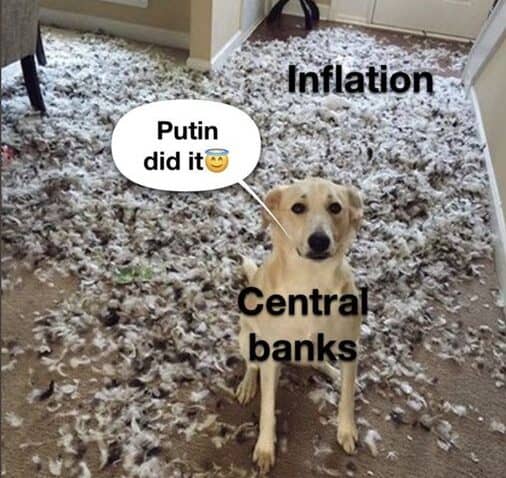

Why Is Inflation Currently So HIGH? Why Is Inflation Currently So HIGH? The first thing to acknowledge is that inflation fundamentally arises from an overabundance of CASH and a relative

British Dentist Turned Wealth Educator Launches Learning Platform For Professionals Seeking Financial Freedom British Dentist Turned Wealth Educator Launches Learning Platform For Professionals Seeking Financial Freedom After spending years of

Limiting Beliefs When It Comes To Wealth Limiting Beliefs When It Comes To Wealth “Money is the root of all ……”“Money doesnt grow on ……”“Money can’t buy …..”If you found

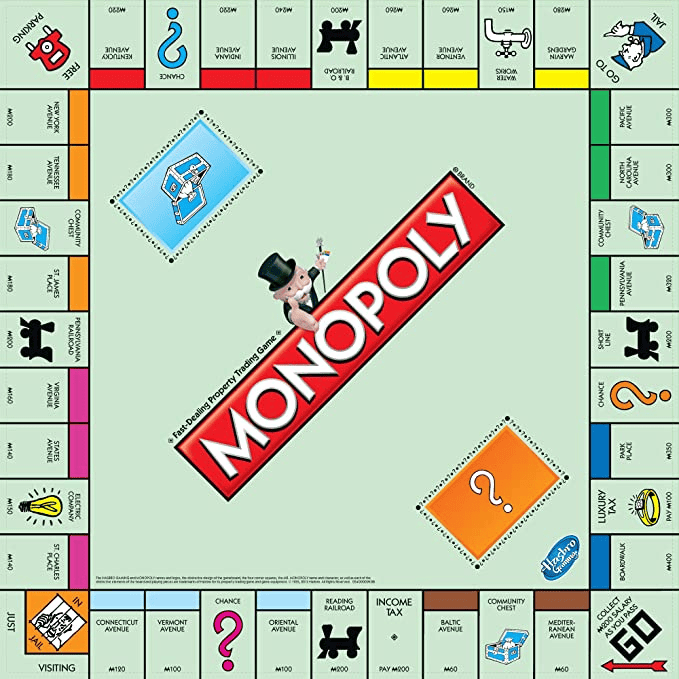

A Game of Monopoly A Game of Monopoly I recently heard this analogy about investing which I thought was really cool…Analogies are pretty powerful because they compare something we currently