The £100 Million Bank Note

The £100 Million Bank Note The £100 Million Bank Note So this is actually a thing…It’s a £100 million bank note issued by the Bank of England (non-circulating sadly).They are

If I had a pound for every time someone asked me this… then maybe Id have between £5 to £7.

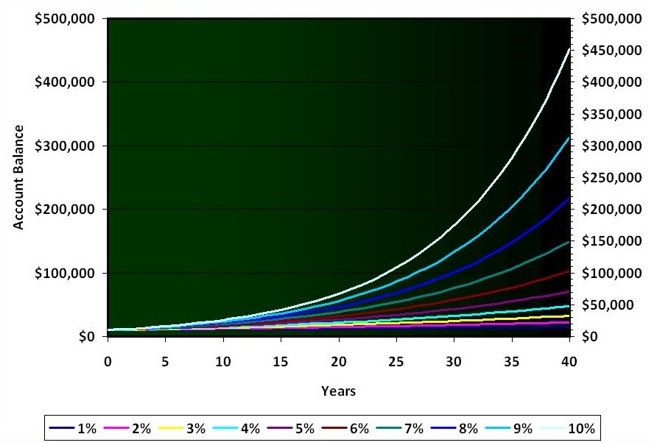

Oddly, people are not as obssessed about returns as one might presume – but it plays a huge factor.

Whilst returns are important there are many more things to consider when make a decision about where to invest our wealth.

There are two ways to measure returns:

1. Growth in value.

2. Yield.

Growth in value is the obvious one that every looks at – it denotes how the assets appreciate in price over time.

Yield is the rate that the asset throws off income relative to its value.

“Returns” can be either one or both of these things. So we cant just measure returns as the only metric we also need to know how these returns are constituted i.e. how much is growth in value and how much is yield.

Most of the time I find what people really want is yield – this is the thing that will give them additional cashflow therefore allow them to reduce their reliance on work very soon.

This could mean that they drop a day a week at the dental surgery.

The issue is that most of the time their investment strategies focus on assets which are designed to prioritize growth in value.

Broadly speaking – Investing in your ISA and Pension is not advised if you wish to prioritize yield.

To paraphrase – investing in these accounts will not give you “passive income”.

If you wish to prioritize yield (what some call “passive income”) within your investing, you should consider the following assets:

1. Property (long game generally – yields tend not to be that high)

2. Purchasing/starting a business (riskier but true scope to generate passive income)

The other alternative to this is an investment startlingly few people talk about yet is one the most powerful – Investing in your skills and knowledge.

This is the investment that Ive seen pay huge returns. One can increase their income to such a degree that they basically dont have to work – this is how the passive income lifestyle SHOULD look.

The more you know.

*Not Financial Advice

Disclaimer: The content on this blog is meant for informational purposes only and does not constitute financial advice. Readers should seek guidance from a professional financial advisor before making any investment decisions.

The £100 Million Bank Note The £100 Million Bank Note So this is actually a thing…It’s a £100 million bank note issued by the Bank of England (non-circulating sadly).They are

3 Years Ago I Was Deeply Unhappy In Life… 3 Years Ago I Was Deeply Unhappy In Life… 3 years ago I was deeply unhappy in life…Whilst I did enjoy

99% Of Investing Info On The Internet Is B.S. 99% Of Investing Info On The Internet Is B.S. Yep – its true. Most of the investing stuff you see out

How Often Do You Look Back On Your Life And Think “I Wish That I Knew Than What I Know Now?” How Often Do You Look Back On Your Life

What Is Your Definition Of Retirement? What Is Your Definition Of Retirement? Re-reading “The Almanack” by Naval Ravikant – this passage always makes me think.What is your definition of retirement?Retirement

Can I Invest In My ISA For Passive Income? Can I Invest In My ISA For Passive Income? Is a common question that many ask when it comes to finance.The

So What Is Chatgpt And How Can It Help Dentists? So What Is Chatgpt And How Can It Help Dentists? What exactly is ChatGPT? Simply put, it’s an advanced language