So How Does One Get Exposure To Gold?

So How Does One Get Exposure To Gold? So How Does One Get Exposure To Gold? I see this question pop up from time to time so thought Id write

I see this question pop up from time to time so thought Id write a post which explains it in full – fundamentally there are 4 ways to get some exposure to gold.

These four ways are definitive meaning that no others exist. This is of course not investment advice and one should seek qualified advice from a financial advisor.

The more educated we are the better the decisions we make so read on to learn more…

The four ways to “own” inflation via possessing gold…

1. Physical Gold held personally.

This involves purchasing and receiving in person quantities of gold from reputable dealers online or offline. These can be purchased and taken in hand or delivered to your house via armoured transport.

Of course, this leads to issues in terms of custody as one must find a suitable place to store their gold within their home. Be this under a bed, a pillowcase or even buried in the garden.

It is the purist’s method of choice given that this gold is in one’s own physical possession.

It is also worth noting that at the time of writing one can buy gold coins form the Royal Mint. These are seen as currency rather than a commodity and therefore CGT does not apply when selling them on.

2. Physical Gold held via a third party.

Gold can be purchased via 3rd parties which retain one’s gold on their behalf. It is held in vaults across the world. Some 3rd parties will even allow one to select which city they hold the gold n. A factor in this will be the relative faith one has in the government of that jurisdiction.

Of course, this would mean cannot necessarily touch their gold with their own hands. However, delivery can usually be arranged on request. The purists in the audience dislike this as they state that one of the main rationales for owning gold is the fact it is tangible.

There can be issues with custody as there is not always means to independently verify that the broker has all the gold they say they do. Also, It is not completely unheard of that national governments can repossess their nations gold it time of hardship. Read up on FDR’s 1931 “New Deal” if you don’t believe me. Although unlikely, stranger things have happened.

3. Gold Stocks ETFs/Individual Companies.

This is the method most opt for – one can purchase stocks in individual gold companies. As the price of the main product of these companies (gold) fluctuates so do their valuations. This means that one has obtained exposure to the underlying asset.

One of the benefits of this would be that one can obtain gold exposure via a tax wrapper (e.g., ISA or SIPP). Another would be that companies tend to pay a dividend (yield) which gold normally does not. Therefore, one obtains an additional form of income from this.

Of course, a downside would be that if investing in individual companies you expose yourself to the risk of the company being liquidated. Again, the purists would argue that you are investing in paper assets (shares) meaning that you having nothing tangible to show for your endeavours. Gold can be seen as a hedge against the collapse of capitalism. Via purchasing stocks via a tax wrapper, you have inadvertently bought a stake in the future of capitalism via the stock market.

4. Spread betting.

This involves betting on the price of an asset as to whether it will go up or down. Specialised brokers provide this primarily making their money from “the spread.” The spread is the difference between the cheapest buy price and the highest sell price.

The interesting thing about spread betting is that the proceeds are tax free given that they are technically classed as “gambling” in the UK.

The dark arts – illegal in America but legal in the UK – this certainly requires some skill and know how to pull off. Only for the experienced investor.

Whatever method you choose (if any) the more knowledge you have is the more empowered you are to make the correct choice.

*Not Financial Advice

Disclaimer: The content on this blog is meant for informational purposes only and does not constitute financial advice. Readers should seek guidance from a professional financial advisor before making any investment decisions.

So How Does One Get Exposure To Gold? So How Does One Get Exposure To Gold? I see this question pop up from time to time so thought Id write

Who Is James? Who Is James? This community is for Dentists who want to accelerate their journey towards financial freedom. This means that we have freedom of CHOICE in any

What Factors Do We Need To Consider When Investing? What Factors Do We Need To Consider When Investing? Fundamentally we can actually distil the forces that govern our success in

The Cost Of Doing Nothing The Cost Of Doing Nothing It’s a common and important query.Let’s compare: (!)Imagine if there was an investment that…. Is tax free Cannot be taken

What Is The Best Long Term Investment? What Is The Best Long Term Investment? Great question – and really “the best” can only be defined relative to your overall objective.For

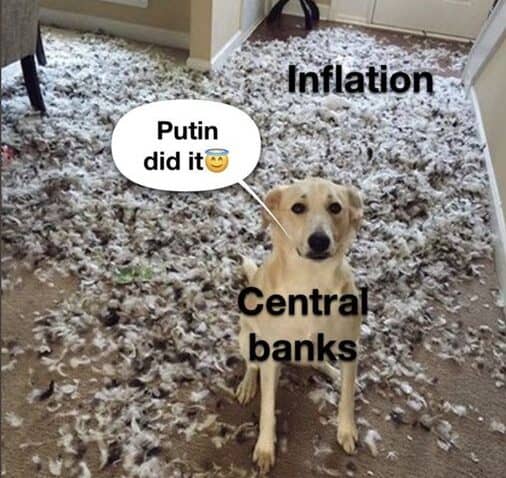

Why Is Inflation Currently So HIGH? Why Is Inflation Currently So HIGH? The first thing to acknowledge is that inflation fundamentally arises from an overabundance of CASH and a relative

The Story Of How The Bank Of England Was Created Is An Interesting One The Story Of How The Bank Of England Was Created Is An Interesting One It all