Can I Invest In My ISA For Passive Income?

Can I Invest In My ISA For Passive Income? Can I Invest In My ISA For Passive Income? Is a common question that many ask when it comes to finance.The

Did you ever wonder how America elevated itself and the world out of the Great Depression?

In 1929 America (and by association the world) fell into a huge economic depression. This occurred because debt levels became so high that the individuals and organizations within society could not afford to effectively repay what they owe and in addition the interest.

Think about it: if you owe so much money that you are unable to repay it out of your earnings you may need to sell some of your assets to obtain the cash required. What about when a lot of people all at once owe a lot of money? When people start to sell their assets on a macro scale this means that the prices of these assets would tank. I.e. if everyone tried to sell their house/stocks/gold at once imagine how much they would go down in value?

Whilst the value of these assets depreciate more and more need to be sold in order to cover debt repayments and hence this process becomes a runaway train. This means that the stock market crashes and everyone becomes poorer and poorer. This is known as a DEFLATIONARY SPIRAL.

Now, how does one make the price of something go up? Well the laws of supply and demand state that normally when there is competition to purchase something the price goes up. In order to purchase something someone must have CASH.

But what happens when no one has any cash? Then it must be created.

The issue was that around this time the value of the dollar was pegged to gold. For every ounce of gold in the reserves of the central bank $20.67 could be created. Cash could not be created arbitrarily as it can now ONLY when enough gold was possessed for it to be issued against.

America’s Central Bank, The Federal Reserve (the FED) needed cash and in order to obtain it GOLD was required. It was down to The President, Franklin D. Roosevelt (FDR) to solve this.

As part of FDR’s New Deal to fix the economy he issued a proclamation. He made it ILLEGAL for American citizens to hold gold privately. To legitimize this he cited concerns against hoarding. He ordered that every American citizen in possession of gold was to sell it to the American Government at market price ($20.67). The authorities in America thus began the process of forcibly ensuring people sold their gold to the government.

Now, here’s the kicker: Once the American government had obtained a great deal of gold from this policy…. They changed the rules! The government then proclaimed that gold was now worth $35 an oz.

This meant the government in effect DOUBLED their money by simply changing the rules to suit their needs.

Of course they then injected the money into the economy which meant that asset prices began to rise. People all of a sudden had wealth once more and were able to manage their debts. This eventually lifted America out of the great depression!

Did the end justify the means? People have debated this to this very day.

Certainly the one thing we can agree on is that it set a worrying precedent as to what lengths a government will go to in order to survive. Are our assets truly safe? This article is by no means intended to scare – only to make you think. It’s truly mind-blowing that this happened within living memory.

Interestingly, avoiding this possibility is part of the philosophy behind crypto. This makes it an interesting proposition as part of a balanced portfolio.

*Not Financial Advice

Disclaimer: The content on this blog is meant for informational purposes only and does not constitute financial advice. Readers should seek guidance from a professional financial advisor before making any investment decisions.

Can I Invest In My ISA For Passive Income? Can I Invest In My ISA For Passive Income? Is a common question that many ask when it comes to finance.The

So How Does One Get Exposure To Gold? So How Does One Get Exposure To Gold? I see this question pop up from time to time so thought Id write

The £100 Million Bank Note The £100 Million Bank Note So this is actually a thing…It’s a £100 million bank note issued by the Bank of England (non-circulating sadly).They are

Time Time TimeA huge revelation for me was to understand the illusion of just how much time we REALLY have.Its so so easy to walk through life in a dream

Should I Trade Or Should I Invest? Should I Trade Or Should I Invest? The age old question. ?I guess we should start by defining the strategies of trading vs

The Gap The Gap So what is “The Gap?” The gap is the difference between the life that we currently have and the life that we aspire to have.Many aspire

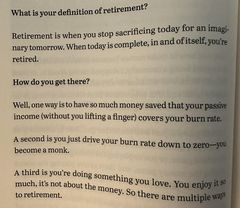

What Is Your Definition Of Retirement? What Is Your Definition Of Retirement? Re-reading “The Almanack” by Naval Ravikant – this passage always makes me think.What is your definition of retirement?Retirement